Wind and Solar Stocks Move Higher

The Trump Administration’s bark is proving far worse than its bite.

Thanks for reading Dividends with Roger Conrad! If you like what you’re reading, why not check out my paid service Dividends Premium, with a risk-free trial?

You’ll receive access to my actively managed model income and growth portfolio, Dividends Premium REITs and 24-7 access to the Dividends Roundtable forum I host on Discord. Happy Spring everyone!—RC

Watch the impact of politicians’ actions, not what they say in the press or on social media: Those wise words are proving their worth again to investors in the early days of the Trump Administration.

Conventional thinking is still that the new government will crush renewable energy in the US, if not the world. And newly appointed Trump officials haven’t been shy about feeding those flames.

Last week, for example, Environmental Protection Agency announced 31 as-yet unspecified “historic actions” in what agency boss Lee Zeldin called “the greatest and most consequential day of deregulation in US history.” And to quote:

“We are driving a dagger straight into the heart of the climate change religion to drive down cost of living for American families, revitalize the American auto industry, restore the rule of law, and give power back to the states to make their own decisions.”

Them is fighting words, to put it bluntly. And they coincide with a North Dakota jury awarding Dakota Access Pipeline operator Energy Transfer LP (NYSE: ET) $650 million in its lawsuit against Greenpeace. That’s for damages allegedly sustained during construction of the Dakota Access Pipeline, which entered service in 2017 but has remained a target of protesters.

Energy Transfer doesn’t need the money—which is a good thing for shareholders. Like other litigation the pipeline operator is involved in, this case is likely to take years. And Greenpeace is only the fifth largest environmental advocacy group. So there are plenty of other organizations to take EPA to court, which appears likely on many of the agency’s 31 proposed “actions.”

According to Just Security’s The Tracker, as of March 18 there are already 132 ongoing federal court challenges of Trump Administration executive orders. That includes several the EPA and the Interior Department are already being forced to defend. And the government’s record so far upholding Trump orders is fairly dismal.

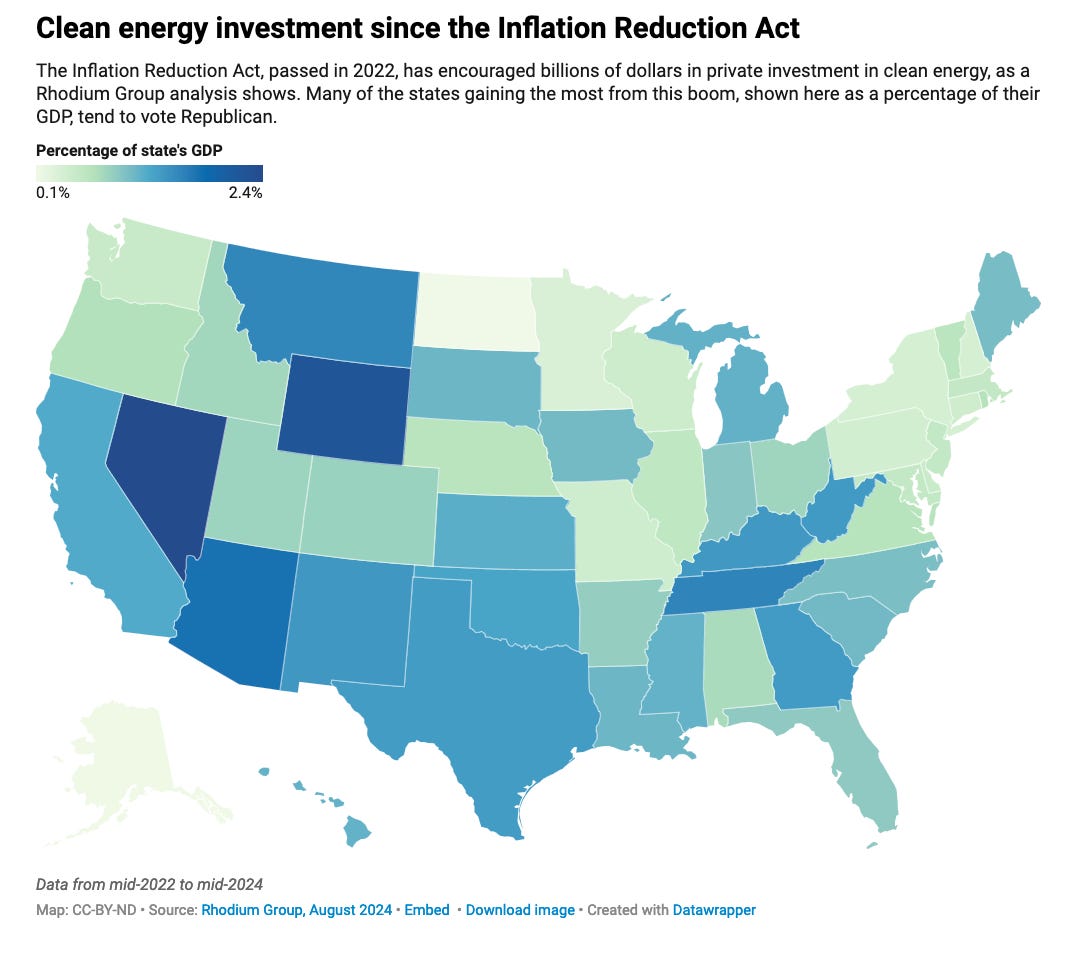

Efforts to repeal the Inflation Reduction Act—a stated goal of the president during the campaign—may also be foundering.

Before the November 2024 elections, Republicans in the US House of Representatives voted 29 times on the floor and 25 times in committees and subcommittees to repeal the act. But this month, Politico reported 21 House Republicans threatened to fight any attempt at repeal. And they apparently made good on that a week or so later, as IRA repeal was not part of the deal worked out to keep the government open.

It’s highly unlikely all 21 will back off, given their districts have been particular beneficiaries of the tax credits. And that’s what it will take to move any legislation, with just a one-seat Republican voting majority and Democrats universally opposed to repeal.

Another big reason to doubt repeal: IRA includes a massive $15 per megawatt hour subsidy for operating nuclear power plants. Eliminating that would cut the deficit. But at least a dozen operating nuclear facilities would overnight become unable to compete on price with new solar, wind and natural gas.

In contrast, eliminating IRA’s wind and solar tax credits would arguably increase the federal deficit.

Why? Simply, with no tax credits, the bar for investment in new wind and solar would be much higher. So fewer new facilities would be built to collect taxes on.

The Trump Administration is a vocal supporter of nuclear power. In fact, earlier this week with great fanfare, Department of Energy Secretary Chris Wright released $57 million of a $1.52 billion loan guarantee to reopen the shuttered Palisades nuclear facility in Michigan, asserting “Today’s action is yet another step toward…lower costs for the American people.”

I don’t doubt his sincerity. But a little history is instructive here. Mainly, Palisades ceased operations in May 2022 for a very good reason:

Local utility CMS Energy (NYSE: CMS)—the plant’s builder and its owner prior to 1990s state electricity deregulation—did not renew the power purchase contract with then-operator Entergy Corp (NYSE: ETR).

CMS instead switched to a combination of natural gas and renewable energy that’s since saved customers millions of dollars over the expired nuclear purchase contract. Entergy was unable to re-contract Palisades’ output on anything approaching profitable economics. So it sold the facility to current holder Holtec for decommissioning.

The Michigan state government has since become far more supportive of nuclear energy. But without generous state and federal subsidy—including the loan guarantee—Palisades would not reopen. Neither would Constellation Energy’s (NYSE: CEG) Three Mile Island 1 in Pennsylvania, or NextEra Energy’s (NYSE: NEE) Duane Arnold in Iowa.

Stripping the politics out of energy economics is a chore right now. But the facts on the ground are:

· US Electricity demand is growing at the fastest rate since the 1960s, with consumption now expected to double by 2050.

· US electricity companies are focused on the cheapest and fastest ways to meet the new demand.

· Solar and battery storage account for 80% of the US grid interconnection queue.

· Solar accounts for 70% of the 130 gigawatts of new production capacity coming on line through 2027, with the rest wind and gas.

· Natural gas generation appears to be next in line for a surge, though longer construction times means significant new capacity won’t be in service until later in the decade at the earliest.

· Reopening old nuclear is time consuming and uneconomic without heavy subsidy, even with Big Tech interest high in locking down new supply.

· New nuclear in the US including SMRs will remain largely frozen until developers can provide believable cost projections to investors and regulators.

Perhaps in recognition of these facts, the Bureau of Land Management this week approved the Sapphire project in California. It’s a $262 million, 117- megawatt capacity power line that will be built across federal lands to bring renewable energy to the state grid.

Sapphire’s lead developer is EDF Renewables, a unit of the French national electricity utility. That’s the company developing the Atlantic Shores offshore wind facility in New Jersey, which ironically the EPA pulled previously granted permits for this week.

The Trump Administration’s action is another delay for Atlantic Shores, which recently lost major investor Shell Plc (NYSE: SHEL). The decision will be appealed. But the action has raised speculation of similar challenges to the other four offshore wind facilities now under construction

Those are: Dominion Energy’s (NYSE: D) Coastal Virginia Offshore Wind, Equinor ASA’s (Norway: EQNR, NYSE: EQNR) Empire Wind 1, Iberdrola SA’s (Spain: IBE, OTC: IBDRY) Vineyard 1 and ORSTED’s (Denmark: ORSTED, OTC: DNNGY) Revolution Wind.

But all four developers’ stocks are well in the black this year, including since the EPA pulled Atlantic Shores’ permit. And Dividends Premium recommendation Clearway Energy (NYSE: CWEN)—a producer of wind and solar under long-term contracts—is up close to 20%. That’s as the stock market’s Big Tech leaders are in correction territory.

The Trump Administration may challenge other offshore and onshore wind projects. But the approval of the Sapphire power line may also augur more below the radar pragmatism. And keep in mind pulling existing permits on energy projects won’t be viewed favorably by the president’s oil and gas sector supporters: That’s because it sets a precedent for shutting down oil and gas projects on federal lands, quite possibly as soon the next election cycle.

Also, companies will adapt to a perceived increase in long-term US energy regulation risk by demanding a much higher return on investment in this country. That means less supply and a higher cost of energy for all Americans.

In any case, economics, not politics, are what’s shaped energy investment returns in the past.

The first Trump Administration was publicly hostile to renewable energy. But its four years were boom times for green stocks. Conversely, the Biden Administration was extremely supportive of renewable energy. But its four years in office witnessed an historic sector crackup, including the implosion of the rooftop solar business.

Stock market history never exactly repeats itself. But so far, Trump 2 is shaping up as a very profitable rhyme for renewable energy—and for investors who can keep politics out of their heads and portfolios.