Utility ETFs Are Top Heavy

But massive gains lie ahead for many high quality sector stocks.

In my first Substack post this year, I called utility stocks the “New Tech.” And I forecast a robust 2024, with the sector taking over market leadership.

That’s exactly what’s happened. The Dow Jones Utility Average is ahead roughly 23% year to date, and on track for its biggest annual gains this decade. Since late April, it’s up nearly 30%, or almost 20 percentage points better than the S&P 500, as well as the Big Tech dominated Nasdaq 100.

The DJUA is still about 2% short of its April 2022 all-time high. And the largest utility stock by market capitalization, NextEra Energy (NYSE: NEE), is almost 10% below its late 2021 peak, despite being up almost 30% since late April.

But many of the largest stocks within the DJUA have set new records, including Duke Energy (NYSE: DUK), Edison International (NYSE: EIX) and Southern Company (NYSE: SO). And a cursory technical read says they’ll head higher.

How much further can utilities run, with the broad stock market troubled by emerging economic weakness and big tech stocks looking increasingly stretched?

Let’s first look at the two main factors behind this year’s rally:

· Rising investor expectations that the Federal Reserve will cut benchmark interest rates.

· Increasingly attractive investment themes.

Contrary to popular wisdom, utility stocks since World War II have performed just as well or better when interest rates were rising as when they were falling. That’s because they’re stocks—and stocks always do best when the economy is strong and company earnings are rising.

This rising rate cycle has been more damaging than most for two reasons.

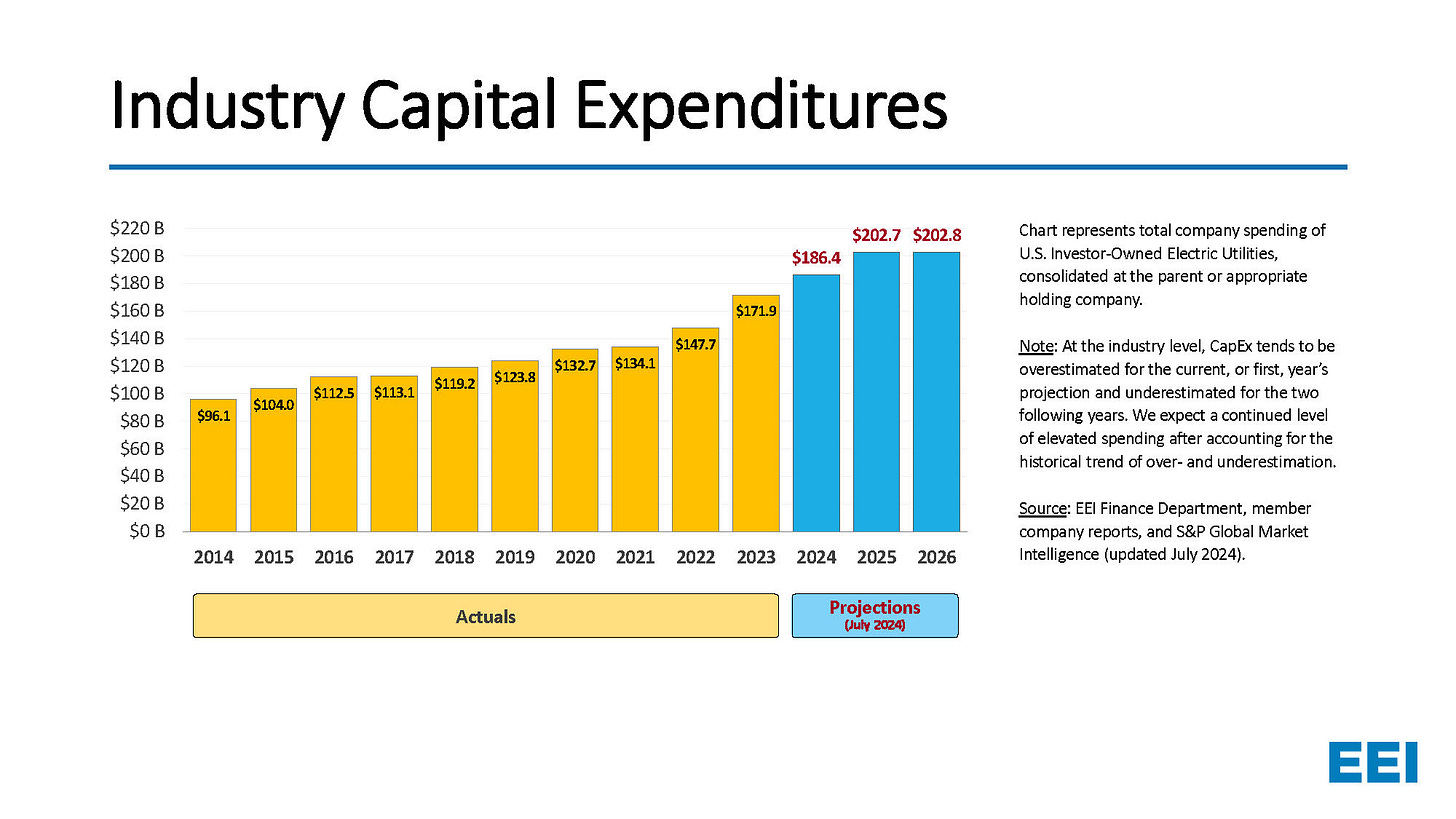

First, utilities are in the middle of a multi-year period of elevated capital spending. Debt finance is essential to pay for new infrastructure. And many investors have feared the suddenly higher cost of capital would undercut returns from new assets, or worse force companies to curtail plans.

Second, the sharp backup in short-term interest rates made dividends less attractive, relative to cash alternatives like money market funds and CDs.

As it turned out, rising rates did not cause a utility sector profit Armageddon. Most states haven’t raised “Return on Equity” enough to fully offset the negative impact of higher borrowing costs—one notable and perhaps surprising exception being California.

But combined with utilities’ skillful timing of debt sales including low cost “green” bonds, sales of non-core assets and use of Inflation Reduction Act tax credits, regulators have helped minimize the negative impact of higher interest expense on the bottom line. And many utilities have fully offset debt expense increases with cost cutting elsewhere, including using more renewable energy and nuclear power to cut purchases of natural gas.

As a result, utilities are still meeting and beating guidance, including long-term targets for future earnings and dividend growth. And a return to lower interest rates and borrowing costs should help them grow even faster.

Today’s elevated yields on money market funds and CDs aren’t likely to drop back to 2021 levels right away. But they will decline, increasing the appeal of dividend stocks. And utilities are now the beneficiaries of several popular investment themes that are gaining traction.

I highlighted electric companies’ essential and unique role powering AI data centers in the April issue of Conrad’s Utility Investor. Since then, the theme has become a major upside catalyst for stocks, including Dominion Energy (NYSE: D) serving the northern Virginia data center corridor.

More recently, AI growth has spurred new interest in nuclear power, including “collocating” data centers near operating plants. I explored that theme in my August 4 Substack “American Nuclear Power is Back,” and at greater length in the August Conrad’s Utility Investor.

US yearly electricity demand growth has hardly budged above 1 percent in recent decades. But that’s still a massive number for a system as large as America’s. And some utilities are now showing year-over-year growth as high as 4 percent.

Over 40 years in this business, I’ve seen plenty of big projections fizzle. And it’s possible today’s AI talk will prove to be empty hype, as may efforts to electrify transportation, heavy industry and building heat.

But there’s a big difference this time: Mainly, these electricity demand increases are occurring in real time. And so long as utilities are able to manage the investment, the higher their stock prices will soar.

Two more reasons utility stocks are likely to go higher the next 12-18 months: Record under-ownership and sheer momentum.

Earlier this year for the first time, money passively invested in stocks exceeded what’s actively managed. Fewer decision makers with the ability to move markets make for faster and more violent action. And momentum can run a lot further in one direction than anyone can stay solvent betting against it.

Utility stocks, despite their spring/summer move, are still historically under-owned at barely 2% of the S&P 500. That compares to the record 30% plus for Information Technology. And the DJUA sells for 17.9 times expected 2024 earnings with a yield of 3.5%, quite cheap relative to the S&P’s 25.3 times and 1.3%.

Bottom line: Utility stocks will have to rise a lot more for the stock market to return to balance.

If extremely expensive and extended Big Tech rolls over this year, utility stocks won’t fully avoid downside. And despite the disastrous history of politics-based investment strategies, many investors will insist on following them through the November elections, raising volatility especially for stocks associated with renewable energy.

Loaded with stocks now making record highs, utility ETFs are likely to bear the brunt of any stock market declines this fall and winter. And dividends hardly compensate for the risk: The Utilities Select SPDR Fund (XLU) pays just 2.8%.

The solution: Focus on individual utility stocks of strong companies yet to fully participate in the run.

Last week, my friend Lowell Miller—founder of Miller Howard Investments—reminded me that “reversion to the mean” has historically been the most reliable predictor of investment performance. And as last week’s Substack post “Rocky VIII: The Rebounding Utility Creed” made clear, utilities are the only sector with a virtually unblemished record of recovery from even the worst disasters. That’s something to bet on.