Thank you for reading Dividends with Roger Conrad. If you like what you’re reading, please consider going one step further with a trial subscription to Dividends Premium.

You’ll receive access to my actively managed model income and growth portfolio, Dividends Premium REITs and 24-7 access to the Dividends Roundtable forum I host on Discord. See this email and the Substack app for more information. To your wealth!—RC

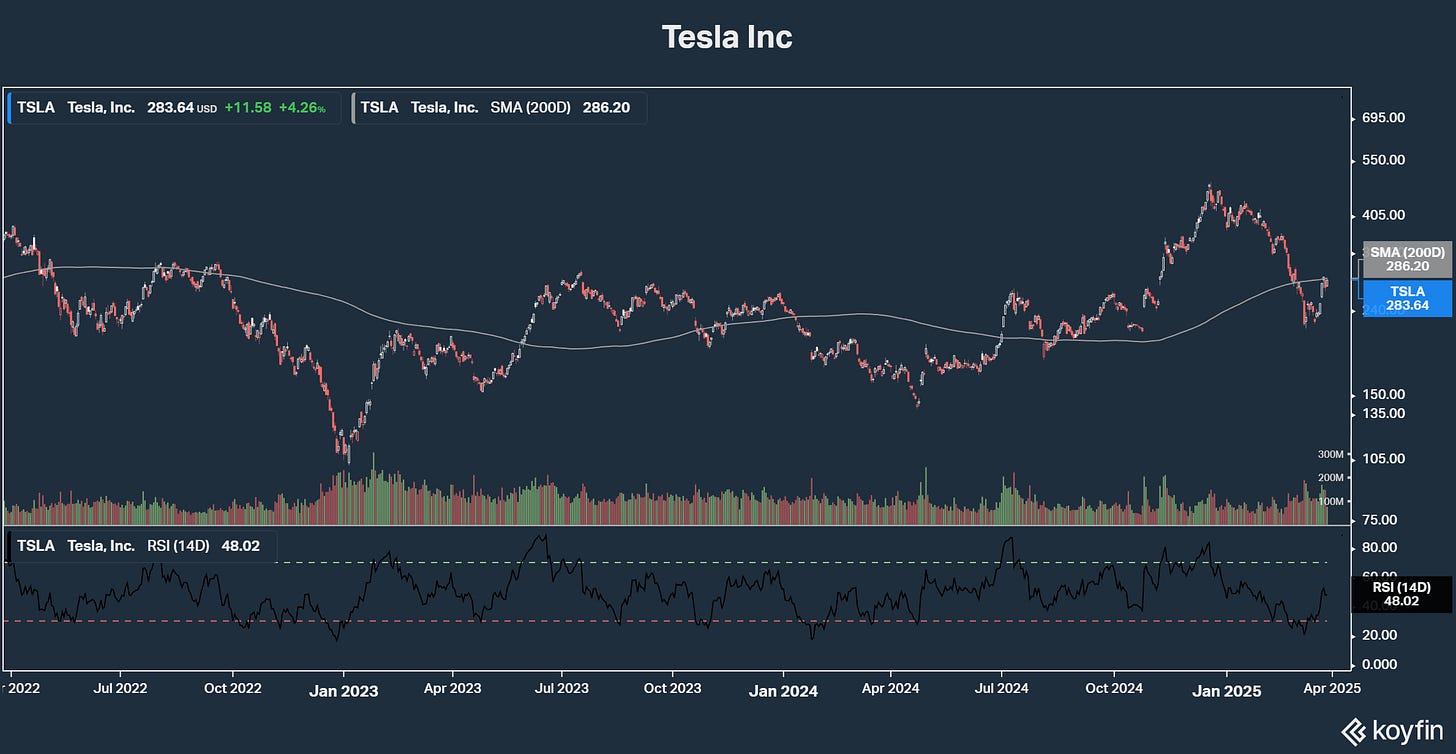

In mid-December 2024, shares of electric vehicle manufacturer Tesla Inc (NSDQ: TSLA) reached an all-time high of nearly $500.

Then they dropped by nearly 60%. Weaker than expected global sales, the announcement of a dramatic advancement in EV charging technology by arch rival BYD Electronic (OTC: BYDIY) and a general cooling of the stock market’s highest flyers all factored in.

This is hardly the first time Tesla stock has come down hard after a dramatic rise. In 2022, for example, shares lost more than two-thirds of their value from top to bottom. And by summer 2023, the stock rallied nearly 300%.

Now a large number of individual investors are apparently betting on a repeat performance for 2025. And so far they’ve been right: After touching a low of less than $220 earlier this month, shares are once again pushing toward $300.

Those who’ve read my stuff for any length of time will know I’ve been a fairly consistent Tesla skeptic over the years. The company has made electric vehicles cool, where before the perception was basically they were glorified golf carts.

There’s no denying CEO Elon Musk’s abilities as a rainmaker—consistently raising extremely low cost debt and equity capital in any environment. And the company’s numbers have demonstrated economics of scale in recent quarters—with higher sales boosting operating margins.

All those are good reasons to bet on a Tesla rebound. But before you leap, here are a few facts to chew on regarding risk.

First, Tesla is not a cheap stock even 40% below its all-time high. In fact, it’s fair to say the share price is completely unmoored from business value, selling for 140 times trailing 12 months earnings, 108 times expected next 12 months profits, 13 times book value and an enterprise value 9.2 times annual sales.

That compares to 7.4 times trailing earnings for General Motors (NYSE: GM). GM also sells for just 4.1 times expected next 12 months profits, 70% of book value and enterprise value of just 0.8 times annual sales.

GM is admittedly a far less exciting auto company. And unlike Tesla, it also produces plenty of ICE vehicles—that stands for gasoline and diesel powered internal combustion engine. But GM is still a very important auto company for the US economy, with $182 billion in annual sales. In fact, it’s a great deal more than Tesla, which has $110 billion.

Probably a better valuation comparison for Tesla is BYD Electronic, its chief rival in the global EV market and particularly in China. BYD is actually growing much faster than Tesla. But the stock sells for just 20.4 times trailing 12 months earnings, 14.9 times expected profit for the next 12 months, 2.7 times book value and with enterprise value 7.9 times sales.

Does Tesla’s extreme valuation matter? It’s fair to say it has not to date. But equally, stocks that effectively decouple from actual business value are trading on reputation and investor expectations. Those are notoriously changeable—and when the bubble really does burst, its not a pretty sight.

Second, business isn’t so great right now for Tesla. We won’t see Q1 results until April 17. But indications are the negative trends in Q4 away from real scale economics may have worsened this year. The company’s sales in China in February, for example, fell by roughly half from the year ago month. German sales were even worse, tumbling -76%.

Tesla last year blamed slumping sales on being in between new models, as well as delays in rolling out automation technology in its vehicles. But the real problem may be that it now faces credible rivals in the global EV space, which are simply able to make better cars more cheaply.

Last month, there was considerable hype about a possible full-ahead entry into India facilitated by President Trump. And as if on cue, the company signed a 5-year lease to open its first showroom in the country, which is potentially an even larger market for it than China.

India too, however, already has a domestic EV industry. And attempts to expand there as well as a foray into Saudi Arabia announced last week could also viewed as more attempting to counteract rapidly growing weakness in Tesla’s most important market—the U.S.

Musk’s cozying up to the president has made him a cult icon with MAGA. And it’s certainly possible that will translate into sales of Tesla EVs—which would be real potential game changer for electric vehicle sales in general.

But what is crystal clear is that by inserting himself into America’s divided politics, Tesla’s CEO has alienated what has been the company’s core customer base.

The acts of destruction to Tesla inventory may actually help the bottom line once insurance is collected, effectively moving vehicles the company couldn’t get off the lot. And the wave of Tesla owners now trying unsuccessfully to trade in their cars may subside.

The damage to the brand, however, may be irreparable—especially as other companies bring better EVs to market. And remember that Tesla sales have historically skewed to higher income Americans. These are people who will be able to afford to pay tariffs to buy what they want.

The third reason to be wary of Tesla stock now is company earnings are still dependent on EV subsidy that the Trump Administration has repeatedly pledged to stamp out.

The company appears to have come out better than most rivals with the president’s automobile tariffs announced last week. RBC notes that the tariff language suggests specific carve outs that will favor Tesla over GM and especially German carmakers.

Nonetheless, if EV credits are repealed, it will make far more difficult any attempt to boost sales to Americans who have not been the company’s traditional customers. And repeal would take a huge direct bit out of revenue as well.

For my money, there are multiple stocks that offer comparable upside for far less risk. If you’re going to bet on EVs’ growth, for example, why not follow Warren Buffett into BYD. That company just announced a breakthrough in charging technology—doubling driving range and cutting charging times to 5 minutes. And it increasingly dominates the fast-growing Chinese market, in large part at Tesla’s expense.

The Chinese government clearly sees replacing ICEs with EVs as a way to move toward energy independence. That means BYD’s political position is far more favorable and reliable than Tesla’s—despite Musk’s latest MAGA moves.