Time to Buy High Yield Property

This end-year selloff is a great opportunity to buy top quality REITs

Before I start this week’s message, I’d like to again wish everyone in our Dividends Community the very happiest of holiday seasons. On Friday, Dividends Premium members should have received their December issue of Dividends Premium REITs, highlighting my top recommendations from the themes I explore below in this week’s post.

Our Dividends Roundtable continues to grow with more community members joining the discussion. I host it on our Discord platform. The past week’s topics ranged from the prospects of a particularly battered REIT to the Federal Reserve’s most recent actions, utilities and energy stocks.

To find out more about Dividends Premium and the Dividends Roundtable, check out the upgrade options highlighted in this email, as well as in the Substack application.—RC

Persistent inflation. A disappointing Federal Reserve forecast for the end-2025 Fed Funds rate. Concerns about the global economy in 2025 as China’s stimulus continues to produce unsteady results. Worries about what the incoming Trump Administration will do besides cutting taxes and regulation.

Throw in typical tax loss seasonal selling and it’s no wonder Wall Street’s Santa Claus rally has fizzled. And few sectors have taken it harder than real estate, which has seen once hefty 2024 gains shrink to a low single digit percentage.

REITs also appear to be headed for another year of underperformance relative to the S&P 500. With just a handful of trading days left in the year, the Real Estate Select Sector SPDR Fund (XLRE) is lagging roughly 20 percentage points behind the SPDR S&P 500 ETF Trust (SPY).

Barring a minor miracle, that means a third consecutive year of real property stocks being left in the dust by the so-called broad market averages. And it’s fair to ask the question if 2025 won’t hold more of the same.

REITs, of course, aren’t the only sector to lag the S&P 500 the past few years. In fact—fueled primarily by 7 big technology stocks investors haven’t been able to get enough of—the broad index has left pretty much everything else in its wake. And for many if not most investors, it’s hard to see that changing anytime soon if ever.

It’s also now hard to remember that from April through mid-September, REITs were greatly outperforming Big Tech and the S&P 500. That rotation was fueled in large part by growing investor expectations that the Federal Reserve was on the verge of reversing the spiking interest rates of 2022-23.

But when the central bank at last acted on September 18 with a half point cut, the move to REITs stalled. And though the Fed has since cut the Fed Funds rate twice—including last week—the mid-year flow of funds into REITs has since reversed with a vengeance. And after reaching a yearly peak on November 28, the Real Estate SPDR ETF has plunged 12 percent.

What if anything can bring REITs back? I see three major factors investors are overlooking that ensure a robust recovery, very likely in 2025.

First a confession: I was one of the analysts who thought we’d see the property sector take the lead in 2024. And the three main factors I expect to drive those superior returns in 2025 are pretty much the same ones I cited a year ago. Those are:

· The interest rate spike in 2022-23 is becoming progressively less of a headwind, both for underlying business health and stock market appeal as money market yields drop.

· Businesses are getting stronger across multiple property sectors as indicated by signs of accelerating leasing activity and still firm occupancy, rent collection and rent growth rates.

· REITs as a sector are historically under-owned. It only takes a trickle of stock market rotation to send share prices soaring.

Those factors however compelling weren’t enough to spur a REIT rally in 2024. But if anything, they’ve gained strength heading into 2025.

The Fed’s apparent decision to go slow on interest rate cuts—at least for the moment—has clearly deflated the investment appeal of dividend stocks for many. And REIT share prices have paid the price.

The important thing, however, is the longer-term direction of interest rates is still down. In fact, by electing to go slow, the Fed may be locking in a much longer cycle. And remember that this is a central bank that prides itself on being “data driven,” meaning they only act when metrics they watch show it’s safe to do so. Further, the record shows they follow no indicator more closely than the health of the stock market.

We don’t have to guess right on whether the Fed will cut Fed Funds once or twice next year. The Fed has set extremely low expectations that won’t take much of shift in circumstances to beat.

More important, well-run REITs have long since adapted their businesses to a higher for longer interest rate environment. And as a result, just the rate cuts we’ve seen so far are reviving deal volume, with REITs like Realty Income (NYSE: O) again raising projections. Even if it’s just two Fed Funds rate cuts next year, there will still be a strong positive incremental impact.

That’s a massive difference from the past couple years, when rising interest costs squeezed profit margins while freezing development and deal volume. And this improvement is happening at the same time as lack of development and new deals are starting to compress supply. That includes residential apartments, a property sector many thought would be suffering sharply lower occupancy and shrinking rents by now.

In my view, the REIT bears are overlooking two critical facts regarding underlying business health: First, the memory of the pandemic year’s catastrophic impact is too fresh for management to really get aggressive on expansion, slowly but surely setting up the market for supply shortages.

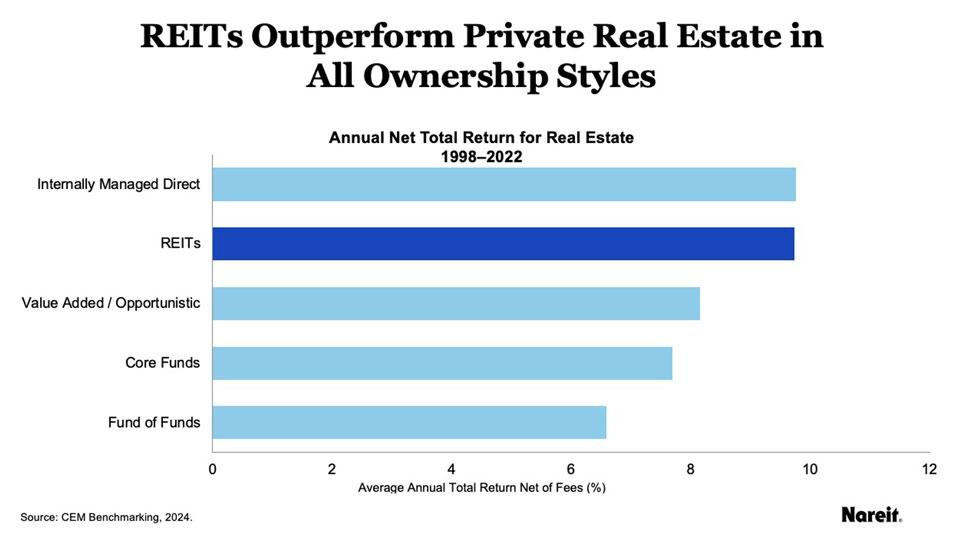

Second, despite several decades of rapid growth, US REITs still collectively control roughly $1.9 trillion of properties versus almost $19 trillion owned in the private market. The best in class like Realty Income have gained the scale to do almost any deal. And the pool of prospects for their growth is deep as ever.

As for being under-owned, real estate stocks including non-REITs are barely 2 percent of the S&P 500 index and the ETFs that track it. That’s versus the one-third of the index in just seven Big Tech stocks, each of which is arguably priced for perfection currently.

I doubt we’ll see much of a REIT rally in the year’s final days. In fact, prices could dip further as tax loss selling runs its course. And political and economic uncertainty could well keep the sector weak in January.

But the best time to buy stocks is always when they’re at their cheapest. And while not every REIT is a bargain, few sectors now offer more high quality companies selling at low prices and generous yields.

Realty Income, for example, sells at its lowest price since last spring. And it yields nearly 6 percent after raising dividends for the 128th time since 1994, one of the surest outward signs of inner strength.