The 3 Things All Investors Must Avoid in 2025

That’s whether you buy for growth, income or safety.

Thanks for reading! I hope everyone in our Dividends Community is having a great start to the Holiday Season on this, the weekend of National Pearl Harbor Remembrance Day.

I’ve enjoyed chatting with several of you this past week in the “Investing Channel” of our Dividends Roundtable. I host it on our Discord platform and I intend to be active sharing more insights and answering questions going forward.

To find out more about Dividends Premium and Dividends Roundtable check out the upgrade options highlighted in this email, as well as in the Substack app.—RC

There are barely three trading weeks left in calendar year 2024. And in the investment advice world that means it’s the season for making forecasts.

In my column last week, I highlighted “3 Things Every Investor Must Do By Year End,” Those are:

· Take the opportunity of the Holiday Season to give your portfolio a thorough house cleaning, selling stocks of companies with weakening underlying businesses.

· Take at least a partial profit in any stock that would leave a real hole in your overall portfolio with a sudden 20 percent drop.

· Take all planned tax losses on stocks you want to sell and re-enter as soon as possible, rather than wait until the end of the year.

I’m reaffirming each of those recommendations this week. And to them, I’m now adding the three things every investor must avoid in 2025.

Number one on my list is to view any and all forecasts for the economy and stock market with a jaundiced eye.

I fully realize it’s literally impossible to avoid predictions if you’re paying any attention at all to investment media these days. In fact, as a 40-year veteran of the advice industry, I can tell you the forecasting season is always prime time for sales.

And don’t get me wrong. I have nothing against making predictions per se. In fact, that’s part of what I do for a living.

It’s just that the more a forecast strays from individual companies and sectors to the so-called “big picture,” the more likely intervening factors will derail it.

Ever wonder why so many widely quoted economists’ forecasts for GDP and inflation—as well as Wall Street analysts’ predictions for where the S&P 500 will end the year—are so similar? It’s because the professionals know the peril of big picture forecasts being way off the mark all too well. Most are just not going to stick their necks out.

Even sector-focused forecasts have a history of wild revisions. The Federal Energy Regulatory Commission, for example, is the primary US government agency regulating energy resources, from electricity to fossil fuels and renewable energy.

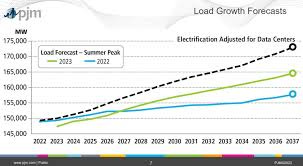

All that access to data should put FERC in prime position to make forecasts about electricity demand. Yet the agency’s 5-year forecast for peak US system summer demand increased by nearly 13 percent between 2022 and 2024.

That’s a massive revision considering how large the US system already is. And it represents almost a nine-fold increase in the projected new power generation needed to meet demand, literally an incremental investment of hundreds of billions of dollars.

Fortunately, America’s electric power system isn’t centralized like Germany’s, for example. Rather, than rely on central government decisions and data collection, utilities and their regulators on the state and local level observe and then collaborate on how to meet projected system needs.

A lot has been written lately about how the US utility system is supposedly unprepared to meet simultaneously rising demand for electricity from artificial intelligence-enabled data centers, re-shoring of industry, electrification of transportation and population growth. And truly, FERC’s wild revisions in projected demand leave that impression.

But while FERC is flailing from 30,000 feet up, utilities are putting plans into action on the ground, based on their own forecasts. And while some face more challenges than others, as a group they’re a great example of why all of us need to keep our feet on the ground when it comes to forecasts.

For investors, that means ignoring 99 percent of what you see this holiday season, other than what’s tightly focused on specific stocks and sectors—with as few variables as possible.

My second thing all investors need to avoid heading into 2025 is the complacency of passive investing.

Every year starts with uncertainty for investors. And 2025 is no different with a new president and Congress and questions about how fast the Federal Reserve will cut interest rates topping the list of so far unanswered questions.

But the biggest risk to passive investors—those who simply systematically deposit funds every year into S&P 500 ETFs or Wall Street products like “Target” funds—is the “baskets” they’re buying are historically weighted to stocks that have already enjoyed an incredible run and are priced to perfection.

I’m speaking of course about the Big 7 Tech stocks. They’re not only trading at record high prices relative to business value. They’re about one-third of the S&P 500 index. That means they’re also historically big pieces of all the myriad ETFs and other products tied to the index. And let’s face it, that’s pretty much everything.

Owners of Target Funds maturing the past few years have already found out how dangerous it is to invest passively by calendar: The bond market crash of 2022-23 cratered fund values, and by extension retirement savings many were counting on.

I’m not forecasting an S&P 500 crash this year per se. But if the Big 7 Tech stocks propping it up gave up say half their gains of the past couple years, we’re looking at a crash of at least 20 percent—and considerably more if the resulting wealth effect on the economy was great enough.

You’re never going to build real wealth if you’re not investing in stocks. But it is certainly time to diversify away from the Big Tech-dominated S&P 500. And that means taking control of your investments and avoiding the complacency that passive investing unfortunately makes all too emotionally possible.

Last but not least, avoid making investment decisions for 2025 based on politics. That was my strong admonition before the election and it remains so with the Trump Administration preparing to enter office in a little over a month.

That’s especially important when it comes to industries where popular opinion is strongest that the incoming government will have a big impact. By this time, the buying and selling has already been done. What’s likely to follow is disappointment—as limits of government power become apparent, as they always do in the aftermath of elections.

Wise advice and FERC exemplifies your point well...Also appreciated the "By this time, the buying and selling has already been done" regarding gov't policy. Thanks for sharing what experience (an irreplaceable teacher) has taught you.