Storm Battered Utilities Need a Break

And despite some angry words, regulators are likely to give them one.

We can debate how much damage from recent storms is due to transcendent factors like climate change—and what’s the fault of urban sprawl into vulnerable areas.

What’s not up for argument is that the magnitude of damage to human lives and property has increased greatly in recent years: Whether it’s from hurricanes in the East and South, flash deep freezes in the Midwest and MidSouth, or wildfires in the West and Rocky Mountain states.

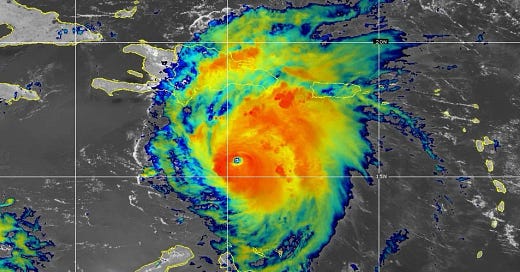

The latest natural disaster to hit the US is Hurricane Beryl, which slammed into the Texas Gulf Coast on Monday July 8—leaving 2.3 billion people in the dark and at least nine Americans dead, with estimated economic damages as high as $28 to $32 billion. And at the epicenter are the region’s major electric utilities, charged with restoring service.

The territory served by Centerpoint Energy (NYSE: CNP) was hardest hit. At Beryl’s peak, 2.2 million of the utility’s 2.8 million customers lost power. Some 72 hours after the storm passed, half were still affected. And management warned as many as 500,000 people will be in the dark into the coming week.

Entergy Corp’s (NYSE: ETR) Texas utility reported peak outages of 252,460, while its Arkansas unit had 11,230. By last Wednesday afternoon, power was restored to all “Razorback Country” customers, as well as roughly half the affected Texans. By Friday, management reported 72% restoration and promised 100% of “customers who can safely take power restored no later than Monday, July 15.

That’s a solid restoration effort. And while the comparison isn’t entirely fair, it’s a welcome contrast to the aftermath of Hurricane Ida in 2021. Then allegations of slow response and inadequate planning landed Entergy in hot water with New Orleans regulators and the public.

This time, it’s Centerpoint drawing fire from angry residents. And scapegoat-hunting Texas politicians are piling on.

Restoration stakes are high. Starving battered utilities of needed investment ensures the grid will fail during the next big storm. But it’s also the path of least resistance for regulators and politicians in the face of outage outrage.

Before Beryl rolled over Houston, Centerpoint was requesting recovery or $425 to $475 million in extraordinary costs from May storms. That’s in addition to what’s needed to absorb 2 percent annual customer growth—the highest in the country—while hardening the grid of America’s fourth largest and most geographically dispersed city.

At 60 percent of rate base, Centerpoint’s metro Houston system is pivotal for earnings and investor returns. And up until Beryl, the company appeared headed for a very constructive decision from the Public Utilities Commission in its ongoing rate case. Fortunately, that still appears highly likely.

Texas’ governor has called for an “investigation” of Centerpoint’s storm performance. And Houston’s mayor has declared the utility “will be held accountable.” That means pressure on the Texas PUC to “punish” the utility. And in fact, the Chairman of the PUC has said the company needs to “restore public trust.”

The reality, however, is hardening utility systems against storms requires heavy investment. For hurricane-prone Houston, that includes undergrounding key lines, replacing wood with high wind resistant materials for above ground poles and protecting substations and generation facilities against flooding. And none of that’s going to get done if Texas doesn’t approve the company’s $2.2 billion resiliency investment plan, with a high enough return to attract capital on economic terms.

Potomac Electric in the District of Columbia—prior to its March 2016 merger with Exelon Corp (NYSE: EXC)—provides a cautionary tale. District regulators routinely punished the company for poor storm response by slashing requested investment returns. And as a result, the utility spent less and performance worsened.

I don’t see that happening in Texas. With the region enduring baking summer temperatures, the patience of Centerpoint’s customers still without power is understandably wearing thin.

But storm restoration efforts have unique mathematics. Mainly, as more customers reconnect, there will be more crews in the field (12,000 in this case) to focus on remaining outages. And while I wouldn’t want to minimize the remaining hurdles—including a return of high winds—there’s a distinct chance Centerpoint will beat expectations this coming week.

Management will have to answer questions about its preparation and response. But whatever the ill feelings are now, Texas has no choice but to keep Centerpoint whole (and Entergy as well) to make the needed investment.

That by the way is also true in Hawaii. Hawaiian Electric (NYSE: HE) still faces an estimated $5.5 billion in lawsuits for its alleged role in the deadly Lahaina Fire on the island of Maui.

But the stock bounced higher last week on news a “massive settlement resolving all claims and lawsuits” may “be on the table” in the next few days. Both the company and state attorney general have confirmed ongoing discussions. And this follows news the Maui Fire Department received results of the fire investigation by the Federal Bureau of Alcohol, Tobacco and Firearms—that it will release as part of its own report.

Hawaiian Electric has claimed there were two fires that day: The first ignited by a power line and later extinguished, with the deadly second fire having an unknown origin. An ATF finding that there was only one fire ignited by the utility could be reasonably assumed as backing the lawsuits. And in that case, the utility would be forced to file bankruptcy and begin negotiations with plaintiffs.

The settlement rumor—combined with the fact the ATF’s conclusions still aren’t public—suggests the evidence is ambiguous enough for plaintiff lawyers to negotiate rather than risk the courts. And that increases odds the utility will remain financially whole to execute Hawaii’s renewable energy and grid hardening goals.

Wildfire/hurricane season has started early this year. And I expect more companies to be hit. But it’s clear regulators in storm hit states so far recognize the essential role of financially healthy utilities. And for investors, that means utility stocks will also recover from storm damage every time.

I spent quite a bit of time in Russia and Kazakhstan 20 yrs ago. I noticed all the electric lines were underground. They have severe snow storms there. Why is it so expensive to do the same here? Seems obvious to do this in hurricane and forest fire states.

Ed