Say No to Nuclear Power/Uranium ETFs

Nuclear’s comeback is real, but investors will lose big betting on empty investment industry hype.

First, let me wish everyone in our Dividends Community a hearty Happy Thanksgiving! I hope all of our Dividends Premium subscribers have had a chance to check out the features of our newly launched Dividends Roundtable.

The Roundtable is also where I’ll be hosting our first meeting of the Founders Circle (still a few memberships left). So stay tuned for more on that. Readers can expect their next issue of Dividends Premium REITs next week.

To find out more about Dividends Premium, please check out the upgrade options highlighted in this email, as well as in the Substack app. Thanks for reading!—RC

There’s an old saying that Wall Street always produces to investor demand. Now with nuclear power suddenly a hot theme, the investment industry’s marketing machines are pushing specialty nuclear power/uranium sector ETFs for the first time in a while.

I have two words: Steer clear.

Don’t get me wrong. I’m a firm believer in a US nuclear comeback.

Electricity demand from artificial intelligence-enabled data centers alone is expected to grow 22 percent a year through 2030. Add in the needs of reshoring industry and electrifying transportation and it’s easy to see the basis for the projected 900 gigawatts of new electricity production capacity needed by 2040.

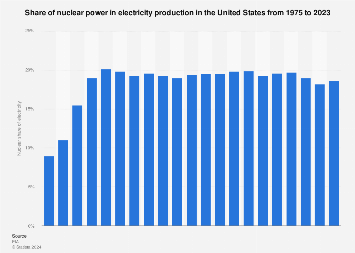

Nuclear power has generated roughly 18 to 20 percent of US electricity in recent years. And it’s absolutely critical to keep as many of the 90 plus operating reactors running as long as possible.

Plans are also being made to reopen nuclear plants closed in the last 5 to 10 years. I count roughly a dozen prime candidates under the right circumstances, facilities that ran well for years but closed because they were deeply unprofitable at the time.

Plans to restart Three Mile Island 1 in Pennsylvania and Palisades in Michigan by the end of the decade are now underway. And TMI has a long-term sales contract with data centers owned by Microsoft (NSDQ: MSFT).

NextEra Energy’s (NYSE: NEE) Duane Arnold plant in Iowa could be next. And TMI’s owner and America’s largest nuclear power producer Constellation Energy (NYSE: CEG) has announced plans to upgrade its existing plants that could increase overall output by the equivalent of several new reactors.

Last month, the Federal Energy Regulatory Commission rejected a “co-location” contract between the operator of the Susquehanna nuclear plant and a Big Tech firm. But the new 3-2 Republican FERC majority next year may overturn that ruling. And it’s likely to remove regulation industry wide as well.

Prospective AI demand is also a spur to develop new nuclear power generation, both large scale facilities such as the AP1000 and SMRs—small modular reactors.

At this time, new nuclear has a major cost problem: Southern Company’s (NYSE: SO) completed Vogtle reactors cost roughly twice initial estimates. And there’s no commercially proven design for SMRs, which means costs are impossible to reliably project.

Big Tech has been willing to support operating nuclear with long-term contracts. And a number of companies like Dominion Energy (NYSE: D) have nuclear in their long-term development plans. That utility owns the site of the two cancelled Summer AP1000 reactors in South Carolina, also a candidate for revival.

But until costs can be clarified, it’s highly unlikely we’ll see new large or small nuclear plant orders, other than prototypes.

Also, if the tax credits embedded in the 2022 Inflation Reduction Act are repealed without replacement, dozens of America’s operating plants could be shut down as unprofitable in competition with increasingly cheap solar and natural gas. Neither will companies take the risk of trying to reopen previously closed facilities.

I’m reasonably confident that won’t happen. Nuclear power enjoys broad support from both Democrats and Republicans, including the president-elect. And with very tight margins in Congress, even reopening IRA will be problematic.

But this life and death threat to US nuclear is also in no way reflected in the prices of stocks like Constellation. That company sells for almost six times what it did when it was spun off from Exelon Corp (NYSE: EXC) in early 2022.

As of the most current available information, Constellation was nearly 8 percent of the MVIS Global Uranium & Nuclear Energy Index (MVNLRTR), which VanEck Uranium and Nuclear ETF (NYSE: NLR) tracks. Leading uranium miner Cameco Corp (TSX: CCO, NYSE: CCJ) has roughly equal weighting and is up almost 65 percent since early September this year.

The ETF itself is up just 34 percent year to date. That makes a good case for playing a theme like nuclear power by picking the best individual stocks, rather than seeking out a basket. So does the VanEck ETF’s track record since inception in August 2007—a capital loss of more than 15 cents on the dollar with an annualized total return of less than 1.7 percent including dividends.

VanEck has by far the longest track record of pure play nuclear/uranium ETFs. But as was the case for “green” energy ETFs launched at that sector’s peak in 2020-21, there are a limited number of companies with actual earnings in its target sector. And as a result, it owns a lot of earnings-less stocks trading purely on hype.

SMR developer NuScale Power Corp (NSDQ: SMR), for example, is expected to lose $134 million this year. Yet it’s weighted at over 5 percent. NexGen Energy Ltd (TSX: NXE) has no revenue and bled $126 million cash the past 12 months. But it’s also over 5 percent after a hype-fueled run starting in early September.

Top 10 holdings Denison Mines (TSX: DML) Uranium Energy Corp (NYSE: UES) are nowhere close to turning a profit and together are nearly 11 percent of the ETF. And noticeably missing are regulated utilities, which collectively generate by far most of America’s nuclear energy. The exceptions are Public Service Enterprise Group (NYSE: PEG) and PG&E Corp (NYSE: PCG), which derive most earnings from regulated utility transmission and distribution service.

You get the point. Only a handful of companies with nuclear power/uranium as their primary business have actual, real earnings. And their stocks have been bid to the sky.

That means the higher an ETF like VanEck ETF rises, the more likely it is to suffer a catastrophic fall.

The silver lining: Even under the best circumstances, it takes a decade to site, permit, finance and build a new nuclear plant, and several years to reopen a closed one. That means this nuclear renaissance is a multi-year investment opportunity—and investors can be patient building positions.

So if you never bought Constellation or Cameco, don’t fret. There will be another opportunity.

Meantime, look for US nuclear power players yet to catch the hype like Dominion Energy. As I pointed out in last week’s Substack post, the Virginia utility is proving its ability to execute large projects: The Coastal Virginia Offshore Wind facility is on time and budget—and with a LCOE (levelized cost of energy) competitive with the lowest cost solar and natural gas projects.