NVIDIA, Utilities and The Best Opportunity to Sell You’ll Ever See

The rise of passive investing is creating historic opportunities to buy low and sell high.

Earlier this year, money “passively” invested in the stock market eclipsed actively managed funds for the first time ever. And the gap is still widening: Passive’s chief apostles Blackrock and Vanguard continue to suck in trillions of dollars with their siren’s calls of rock bottom fees and “practically guaranteed” returns.

When you go passive, no human being will make decisions about your money. Your investment is pooled with that of thousands of other people into a “plan” with a stated objective—typically a target total return by a specified date. Your money is moved around exchange-traded funds (ETFs) using algorithms designed to meet the plan’s objectives.

Passive investing plans now control literally trillions of dollars. So when the algorithms trigger moves, the result is a flood of orders at lightening speeds modern electronic trading makes possible.

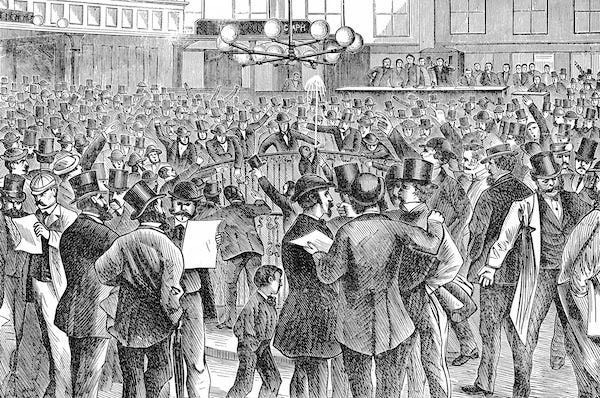

Stock prices, however, are still set the way they’ve been for centuries: By matching up buy orders and sell orders. So when an algorithm controlling trillions of dollars sells, there may not be enough buys to match right away. The stock’s price will drop until there are. And by that time, more algorithms may sell and some active managers may as well, assuming where there’s smoke there’s fire.

Welcome to the brave new world of runaway stock market momentum. And it very much works both ways: An outsized buy order that’s at least temporarily unmatched by sells will push a stock’s price up until balance is restored. The greater the move, the more likely “FOMO”—fear of missing out—will kick in. That means more buy orders from algorithms and managers, and pushing the stock’s price higher still.

The action can get really wild when there are short sellers. For the unfamiliar, short selling is a technique that allows investors who meet certain criteria to sell a stock in advance of buying it back later, hopefully at a lower price.

Short sellers make money when a stock’s price drops. But when prices are rising rapidly, they lose in proportion. A “short squeeze” occurs when the pain becomes too great and short sellers have to buy the stock to close their positions, which in turn pushes prices higher still.

Investors also use “leverage” to capture more upside--borrowing either from credit lines or trading options to buy more stock. This technique is less used now than a couple years ago, because much higher borrowing costs have raised the bar considerably for returns. But heavy leverage can certainly force selling of particular stocks when prices drop enough.

There’s no doubt in my mind that stock market volatility has scared more than a few investors, convincing them to go passive in the hope giving up control over their money will prevent them making a tragic mistake. And that may make sense for those physically unable to make decisions and who lack a trusted friend or family member to help out.

But for the rest of us, this momentum-driven market is a time of staggering opportunity to practice the simplest, time-tested investment strategy of all: Buying low and selling high.

Head-snapping moves in stocks associated with artificial intelligence are pretty commonplace. And no company has had more of them than NVIDIA Corp (NSDQ: NVDA), which despite a selloff Friday is still up nearly 120 percent year to date.

NVIDIA is the leading developer of the 3D graphics processors powering the thriving video game industry and increasingly upgrading data centers for artificial intelligence. That’s a huge business and as Q1 results showed once again, the orders continue to flow.

What’s particularly impressive about NVIDIA is how it’s effectively managed investor expectations that have become ever-more astronomical. Popular media is certainly on board: Last week TV personality Jim Cramer predicted the company’s market capitalization would soon exceed Microsoft’s (NSDQ: MSFT). And he’s hardly going out on a limb, with NVIDIA at $2.7 trillion and Microsoft—the company’s largest customer—at about $3 trillion.

It will be a lot longer before the pair reach anything close to equality in terms of underlying businesses. For the 12 months ended March 31, Microsoft generated revenue of $237 billion, EBITDA of $129 billion and earnings of $86 billion. Those numbers for NVIDIA were $78 billion, $50 billion and $42 billion, respectively.

I wouldn’t rule out NVIDIA ultimately becoming a bigger company than Microsoft, or further gains for the stock. But nothing grows to the sky. It’s the nature of most investors for FOMO to cause them to hang around a big winner when they should have taken at least most of their money off the table. And it can happen with utilities and power companies just as easily as with Big Technology stocks like NVIDIA.

Readers of my Conrad’s Utility Investor will tell you I’ve been pounding the table pretty hard this year for utilities on the basis they’re overlooked beneficiaries of the AI boom. And the potential winners I highlighted in the April feature article have been off to the races since—with the Wall Street Journal recently calling out their performance as “outpacing the competition.”

In my view, utilities are still a mostly untapped AI opportunity. But several of my recommendations have more or less reached the point where investors should consider them sector NVIDIAs.

One of those is Texas-based power generation company Vistra Corp (NYSE: VST). I first got excited about this stock back in January 2020. And it promptly “rewarded” me by losing half its value during the pandemic selloff.

I stuck with Vistra for the most boring of reasons: Free cash flow. Management was successfully executing its plan to cut debt and operating costs, in large part by switching from coal to gas and renewable energy. And it promised a growing pile of free cash flow surplus to raise dividends and buy back stock.

By summer 2020, Vistra had recovered along with the rest of the stock market. And for the next three years or so, it raised dividends more than 50 percent while inching toward investment grade credit ratings. The stock price, however, never managed to crack $30 until late 2023.

That’s when investors got excited about its acquisition of nuclear power plants owned by the former Energy Harbor. Excitement continued to build as AI electricity demand took hold as an investment theme. And last week, Vistra announced it will build up to 2 gigawatts of new natural gas-fired capacity in Texas under government incentives.

The upshot: Even after selling on Friday, Vistra shares are up nearly 160 percent year to date. And with a roughly five-fold gain from our initial entry point, we have a choice to make: Stick around this huge winner and try to ride the momentum a bit further or start taking some money off the table.

The decision is made all the more difficult by the fact electric companies generally are only starting to get credit for their part in the AI revolution. And Vistra still trades at just 18 times expected next 12 months earnings, hardly an extreme valuation.

My advice to CUI readers has been to consider selling some—not all—their Vistra shares and investing the proceeds into other utilities and power companies with AI exposure but yet to catch fire. That’s still the best course in my view.

Vistra Energy is no longer the neglected bargain basement stock I first recommended in early 2020—or even the recovering value stock it was up until mid-2023. It’s now a straight up stock market favorite. Getting the most of the remaining momentum will require carefully managing our gains.