In bygone days, owning bonds was considered essential to investing success—especially for those in retirement or close to it.

Bonds aren’t so popular now after the shellacking of the past couple years. And with the Federal Reserve seemingly holding interest rates “higher for longer,” more than a few investors appear to be swearing them off altogether, especially with basically riskless money market funds yielding well over 5 percent.

That’s a mistake many will come to regret. Total investment in money market funds reached an all-time high of $6.12 trillion last week. But money funds are always priced at $1 a share. That means there’s no possibility of capital gains ever, so your principal is always losing ground to inflation. And when the Fed does eventually start cutting interest rates, your income will drop as well.

Investment returns in bonds, in contrast, are locked in when you buy. And bonds issued by investment grade corporations and governments now yield 6 percent plus, more than they have in 20 years. That includes bonds maturing or paying off in two years or less, with basically no risk to principal from rising interest rates or even a recession. But it’s critical to buy them the right way.

If you’re unfamiliar with bonds, one way to think about them is they’re loans to companies that ordinary investors can buy and sell through brokers. Corporations and governments can borrow money from banks to fund their investments and expenses. But by issuing bonds, they can borrow directly from the public. In return, investors receive semi-annual interest payments. And the full amount of their investment returned when the bonds pay off or “mature” on a specified date.

Unfortunately, it’s not as easy to buy individual bonds as it is stocks. In fact, many bonds basically trade by appointment. Investors must buy what their broker has available in inventory.

Individual bonds trade with “bid” and “ask” spreads. The ask price is what you pay. And for most bonds, it’s generally a percentage point or two above the bid price, what you can sell them for. And that cost is in addition to brokerage commissions and any taxes due.

Investors’ access to bonds can also be limited by how a bond was issued. Those sold by “private placement” or are bound by restrictions such as 144A status can only be purchased by “qualified” investors, as defined by US securities regulation.

Because of these challenges, investors tend to buy and hold bonds until they mature or pay off. That means when there’s a lot of supply or “inventory” for a particular bond, it’s usually because the issuing company or government has weakened. The yields may look attractive. But there’s also elevated risk that’s best avoided by all but speculators.

Small wonder then that investors have sought other ways to own bonds besides picking their own individual securities. And Wall Street has been happy to oblige with products from actively managed mutual funds, closed-end funds and exchange traded funds to (infamously in my view) “target funds” that shift from stocks to bonds based on the calendar.

Target funds have been popular with investors over the past decade or so, mainly because they’ve been marketed as a “one-decision” investment strategy. All you have to do—so the Vanguards and Fidelities of the world say—is decide the year you want to reach your investment goal. You then put your money into a “Target” fund with that date and sit back to watch your money grow.

For Vanguard and other investment company giants, target funds are popular because they’re very cheap to run and extremely scalable. The stock and bond ETFs they shift between can easily absorb billions of dollars. And the only investment decisions made are automatic, so there’s no need for managers, researchers or traders—just an effective IT department.

Unfortunately, as I’ve pointed out in this column on multiple occasions, target funds have been an unmitigated disaster for investors in recent years. Up until the end of 2021, when they added money they had to buy bonds at multi-generation low interest rates. That locked in paltry yields at high prices.

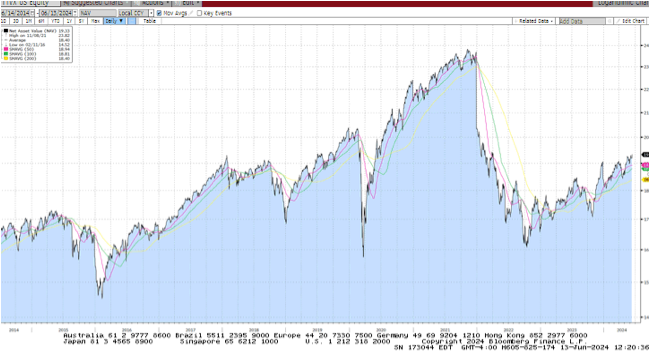

Then in 2022, the Federal Reserve started raising interest rates to rein in inflation. Bond prices dropped to reflect the change in policy. And Target Fund asset values dropped like a stone for two plus years.

I don’t expect any mea culpa from the Wall Street marketing giants for promoting Target funds. In fact, if you’re in a large pension plan, chances are they’re still your main option. And certainly Vanguard and other investment company behemoths are as motivated as ever to sell investors on Target funds.

But the fact remains that Target funds are vulnerable as ever to another jump in interest rates. And though the consensus expectation is for the Federal Reserve to pivot to lower interest rates, inflation is still stubbornly running well above the central bank’s target rate of 2 percent, no matter how you measure it.

Worse, the longer interest rates stay high, the longer investment in key areas like housing and energy will lag behind long-term demand growth. And the more likely we’ll see future shortages that drive inflation higher, after the central bank declares victory.

As I’ve noted in this column, REITs’ Q1 earnings indicate the heavy volume of new housing stock many expected this year is being absorbed far more quickly than anticipated. The combination of elevated mortgage rates, all-time high prices and a dearth of selling inventory have made buying a house prohibitive for many Americans.

Instead, they’re renting, soaking up supply and preventing moderation of rental rates. High rates have caused developers of residential properties to restrain investment. And the result is elevated “shelter inflation” that is likely to be with us for years to come.

As alternative to Wall Street products, consider an active bond investing strategy. That could include buying individual bonds with the help of a knowledgeable broker. I recommend bonds issued by strong companies that mature in two years or less.

Or consider buying bonds using the unprecedented variety of ETFs now available for every market sector. One good resource: Capitalist Times’ newly launched “Smart Bonds” advisory.