Ignore Politics: The Great Stock Rotation is Here

And investors who don’t move now will be crushed underneath it.

Trump bump or Trump slump? Tariffs that stifle global investment and trade or new agreements that eventually boost prosperity? Shutdowns and chaos from poorly executed mass layoffs of federal workers, or less expensive more efficient governance?

It’s hardly surprising popular investment media are fixated on what’s happening in Washington D.C. these days. And I wouldn’t argue that Trump Administration policies won’t have profound implications for many Americans and around the world.

But the allure of politics has taken big and small media’s eye off the ball of the most important investment story this year for investors.

That’s the now nine-month old Great Rotation: From the Big Tech stocks that have led the S&P 500 higher the last several years to what are still relatively cheap high quality dividend and value stocks.

Technically, the S&P 500 still hasn’t officially crossed into “correction territory.” That’s popularly defined as a drop of 10% or more from the most recent 52-week high. And based on the February 19 close of 6144, the big cap average is down just -8.2% after Friday’s big rally.

Nonetheless, the tide has turned for the 10 Big Tech stocks that are currently 35% of the S&P 500. And with less money actively managed than invested passively—largely in ETFs that track the S&P 500 and related indexes—millions of unwary savers are setting themselves up for a potential lost decade.

Before I get too far ahead of myself, let me first say 10 Big Tech companies dominate the S&P 500 for a reason. Mainly, they’re on the verge of changing the world.

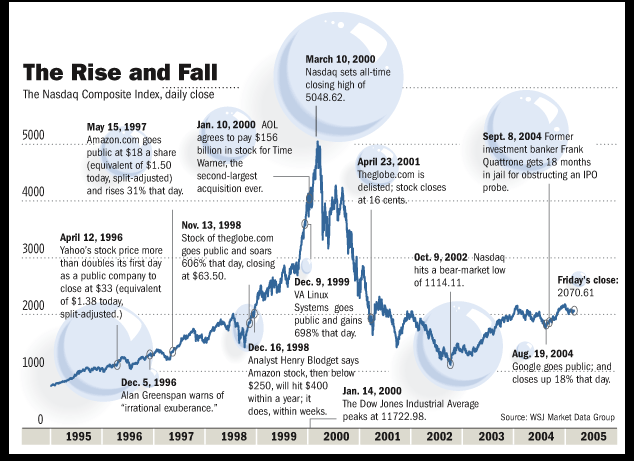

Back in the early ‘00s—a quarter century ago—Big Tech brought us information technology. This time it’s artificial intelligence that’s only starting to get traction in a wide range of industries.

Sure so far, there’s arguably been more hype than substance. And more than a few of the uses AI has been touted for as a replacement for humans aren’t working out so well. But equally, there are others where it’s driving advances. And the future is bright for the companies able to grab a niche and hang onto it in coming years.

That’s the way it’s been since the ‘00s for information technology leaders. The problem for Big Tech stocks now as then is they’ve risen too far, too fast. Now it’s time for fresh leadership and the momentum is shifting out from under the sector.

Even after a -12% drop over the last month, for example, NVIDIA Corp (NSDQ: NVDA) still sells for 41 times earnings and with enterprise value 22.5 times sales. The company is still at the heart of the artificial intelligence revolution as the maker of vital GPUs. But it simply can’t grow fast enough to justify that level of valuation.

And NVIDIA is the third most heavily weighted stock in the S&P 500 at almost 6 percent. That’s more than twice the entire oil and gas sector.

Energy has been in rally mode for four years. But NVIDIA’s weight means it takes a 2% rally for the entire oil and gas sector to offset the negative impact of just a 1% percent decline in NVIDIA. It would take a 20% rally in the mining sector to do the same. Electric utilities would need to rally 4%.

Eventually, the S&P 500 will adjust its weightings. The better dividend and value stocks perform, the bigger piece of index weightings they’ll command. And the more Big Tech lags, the less it will weight and the less important those stocks will be to S&P 500 performance.

Trouble is, balance will only be restored after a period of months or years, following a massive crash or both. That is in fact when happened a quarter century ago, when the Big Tech rally of the 1990s became the Tech Wreck of the ‘00s.

The transition period weighed on big stock market averages like the S&P 500. And that’s why many investors and in the investment media consider the ‘00s to be a “lost decade” for the stock market—when it was anything but for multiple other sectors including energy.

It’s common practice for index sponsors to load up on leaders and dump off laggards. Holding onto lagging high quality stocks—however good that is for investors—does not enhance the near-term performance that’s needed to attract investment dollars to ETFs attached to indexes. And in the economics of the low fee era, the only way big firms can make money is by constantly attracting more dollars by marketing high past returns.

The strategy of concentrating on market leaders has worked for index sponsors the past few years because the largest Big Tech stocks still had room to run higher. But that’s now run out, mainly because the investor expectations reflected in their current prices have simply become impossible to meet.

Market history never exactly repeats. But the longer you invest, the more apparent it becomes that it often rhymes—to paraphrase Mark Twain. Some of us have seen this movie before: The IT boom of the late 1990s that became the Tech Wreck of the early ‘00s.

The leading companies then went on to become giants that still dominate the global economy today. But it took over a decade for those who bought their stocks at their top to get back into the black—even as the leaders of the ‘00s made many investors rich.

The great rotation from Big Tech to a more diversified basket of high quality stocks in multiple sectors is the main theme for investors to keep in mind this year. And if history does again rhyme, it will the dominant theme for many years to come.

That’s going to be very bad news for the millions of Americans who’ve punted making investment decisions. By following the advice of trillion dollar companies like Vanguard and Blackrock—to “just by a good index fund”—they’re going to ride Big Tech lower while largely missing out on the stocks that will lead the latter 2020s.

But the Great Rotation will be immensely profitable for those who take a few simple steps now:

· Take control of your wealth with a plan to systematically pull your money out of passive investments such as ETFs. Put the money temporarily into a good money market fund, where you can get at it.

· Build a list of high quality companies. My Dividends Premium service highlights the best ideas for income investors.

· Begin investing incrementally in your list of stocks. For example, make one-third of your investment now. Buy the second third in six weeks and the final piece six weeks after that.

The last step will put the power of dollar cost averaging to work for you, buying the most shares at the lowest price. Those with a long-term saving horizon should consider using companies’ dividend reinvestment plans, which automatically invest your dividends into more shares. Look for more on DRIPs in a future issue of Dividends.